Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged.

To find out more about any of our services, please select a department from the list provided;

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged.

Please see our related services below;

Agricultural

Whether you are a major landowner, farmer or tenant, we have the experienced professionals to help you plan and implement major strategic decisions as well as resolve day-to-day legal problems. Farmers, like our other business clients, benefit from our expertise in commercial law generally, but the individual nature of their business demands special expertise which we have gained in providing a service to the agricultural community for over a century.

As the law has become more complex, particularly with the development of UK and EU legislation and regulations, the farming community’s needs have become more specialised. We can advise on all aspects of estate management including diversification through building conversions, leisure and mineral exploitation and on opportunities for land development centred on commercial and residential schemes.

We will advise as your business develops over the years with the aim of preserving the farm or other rural businesses within your family. The objective will be to pass on a going concern or inheritance which is not penalised by taxation where there are opportunities to use the special exemptions and allowances the Government have provided for Agriculture and Business. We can prepare your will and discuss with you how lifetime gifts, trusts and settlements can help mitigate the effects of capital gains and inheritance tax.

Services

As farming, rural agri business and agricultural solicitors we can help you with the following:

- Agricultural Holdings Act tenancy matters

- Boundaries

- Business restructuring

- Common land

- Development land sales

- Employment agreements

- Environmental matters

- EU matters/quota arrangements

- Farm tenancies (and succession)

- Partnership agreements

- Rights of way

- Sale and purchase of land and buildings and farm businesses

- Sale of produce contracts

- Telecommunications

- Tied/agricultural accommodation

- Trust and tax planning

- Waste Regulation

- Wayleaves

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged.

Please see our related services below;

Purchase and Sale

Commercial Leases

Development

Planning

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged.

Please see our related services below;

General and Commercial Litigation

Our Litigation Solicitors Mark Heselden and Tim Parsons have a wide range of experience in identifying, dealing with and resolving legal disputes.

We provide you with realistic and practical advice and will work with you to achieve the best possible outcome for you as quickly and as cost effectively as we can, whether through negotiation, mediation or through the courts, if litigation cannot be avoided.

We specialise in the following – contract disputes, business and partnership disputes, inheritance disputes, professional negligence claims, disputes involving neighbours, boundaries and rights of way, property disputes and problems with landlords or tenants.

We will be open about our costs and if possible we will look to recover them for you when working to resolve your dispute.

Initial fixed fee consultation

In appropriate cases we offer an initial consultation for a fixed fee of £360 (£300 plus VAT), which covers:-

- Considering documentation and other information relevant to your dispute provided by you prior to our initial meeting;

- Initial meeting with you to enable us to understand the issues relating to your dispute, so that we can advise you on the position, the options available to you and the likely costs involved depending on how you proceed;

- Written confirmation from us of the advice given to you in this initial meeting.

Otherwise our costs for any work which we may undertake for you in dealing with your legal dispute will be based on the time spent at our prevailing hourly rates at the time the work is undertaken. Currently our hourly rate for such work is £185 plus VAT. However, in more complex or high value cases our charge rates may be higher, but if this is the case, we will let you know at the outset.

Many things will affect the time scale involved in us dealing with your dispute, a number of which will be beyond your or our control. These include court schedules, the actions of your opponent and nature of negotiations. Disputes may be resolved very early in the process or may continue to the end of a court trial. Once court proceedings are issued, the process will take at least 6 months and substantial or complicated cases can take in the region of 12-18 months if not longer.

Debt Recovery

Securing payment of outstanding invoices for work done, or services provided by you is likely to be crucial to the smooth and efficient running of your business.

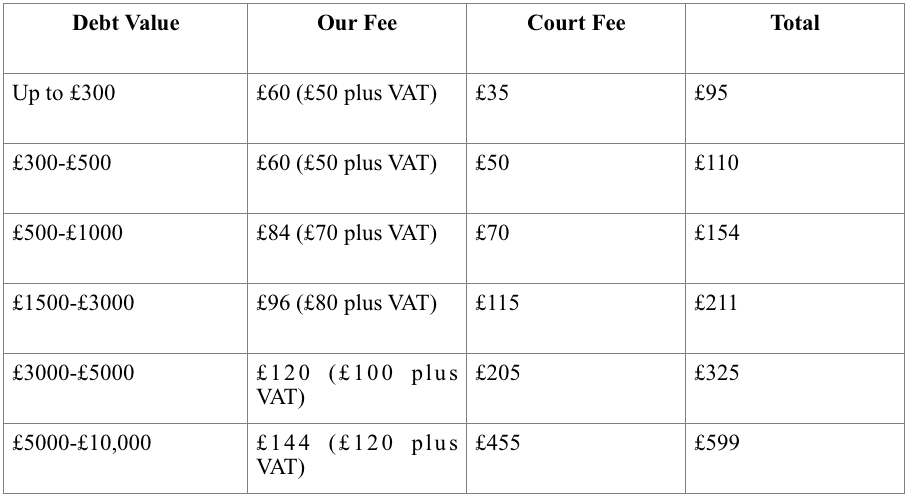

Where your claim relates to an unpaid invoice or invoices of up to £10,000 in value and the work or service you have provided is not disputed, we are able to deal with your debt recovery claim on a fixed fee basis as follows:-

1. Initial claim letter and response – £60 (£50 plus VAT)

This includes obtaining and reviewing invoices received from you and sending a 7 day letter/letter before action, then receiving payment and sending on to you.

2. Preparing and commencing a court claim

This covers where the debt is not paid and we prepare and issue the court claim for you. This does not extend to dealing with the claim for you if the claim is defended. The fees which you will have to pay to both us and to the Court will depend on the amount in dispute and are set out in the table below.

3. Entry of judgment if claim not defended

This covers where no acknowledgement of service or defence is received to you claim and we apply for you to the Court to enter judgment in default and thereafter writing to the other side to request payment.

If enforcement action is needed, the matter will take longer to resolve and the fixed costs quoted above do not cover enforcement action such as instructing the bailiff, if this is needed to collect your debt.

Disputed or defended claims or claims for more than £10,000 – above fixed fees do not apply

Please note that if the debt is disputed by the other side at any time before or during your court claim, then our charges payable by you will no longer be limited to the fixed fees above, but will be based on the time spent at our current hourly rate of £185 plus VAT. Equally if we deal with debt recovery work for you, where the amount claimed by you is more than £10,000 then our charges will be based on the time spent at our hourly rate which is currently £185 plus VAT. In such cases we shall discuss with you what work we will need to undertake for you and the time frame your claim is likely to take and costs which are likely to be involved.

If the money you are owed is not disputed, then matters usually take 3-8 weeks from receipt of instructions from you to receipt of payment from the other side, depending on whether or not it is necessary to issue a claim. This is on the basis that the other side promptly pays on receipt of judgment in default. If the amount you claim is disputed or the debtor fails to pay you, then the matter will take longer and when this becomes clear we shall discuss with you the likely time frame and costs involved.

Generally speaking in money claims for less than £10,000 other than the court fee, you are unlikely to recover our fees for the above work from the other side, no matter what the outcome is and you will have to pay these fees yourself. If you succeed in a claim and recover money due to you of more than £10,000 then the other side are likely to have to make a contribution towards your legal costs in addition to any money and interest they have to repay to you, if your claim is successful.

Whether you are an employer or an employee, we offer in depth support and guidance throughout all of the stages of your matter, drawing on our extensive expertise and experience of work related issues; from advice, the initial drafting of contractual documentation, to the preparation of formal claims that are presented to an employment tribunal, to representing you should matters progress to a hearing.

Please see our related services below;

Employer

You may never have attended a grievance meeting, disciplinary hearing or indeed an employment tribunal before, so it’s only natural for you to seek advice to relieve any anxieties you may have. Having expert lawyers on your side means you can be well prepared and confident that your actions are backed by lawful authority.

Workplace policies and procedures

We regularly assist businesses with their employment contracts. We work with you to identify the key commercial terms, and then help you to decide whether to amend existing contracts or simply introduce new model contracts going forward.

If your business requires that your contracts adhere to a similar format, we will help to achieve that, while ensuring that you remain competitive. Our managed approach ensures consistency. The individual experience of our lawyers also allows us to ensure that the subtleties of your in house employment custom and practice are respected and incorporated into every document.

Day-to-day HR advice

We provide pragmatic step by step advice on which processes should be followed and how to deal with arising issues of conflict in the workplace by having consistent practice and procedures, yet with an air of thinking out of the box if the situation requires it.

Benefits and compensation, recruitment, hiring

We can advise you on the processes to be followed to legally recruit and hire your staff avoiding discriminatory and illegal pitfalls as the law develops for the greater protection of the workforce. We are aware of the difficulties of keeping up with the legislation and the need for businesses to be compliant.

Employment contracts and service agreements

We assist with the review and renewal of both company handbooks and contracts of employment and service agreements for the organisation enabling a legal and consistent manner to be adopted with staff across the board.

Business transfers

Whether it is gaining new staff or the loss of staff by means of TUPE transfer, we provide clear advice and templates to assist you with the disclosure requirements required for due diligence during these processes. Advising on the information to be disseminated to colleagues and staff during consultation processes to ensure that your business is compliant with the legislation but is sensitive to the workforce to protect your business and its reputation.

Discrimination law

In today’s world where diversity is a key word and equality is a key concern for all businesses there is an increasingly diverse workforce which can be demanding on management time with respect to training your workforce and treating every individual in a consistent manner. However, not even the fairest employer is immune to claims of discrimination, harassment and bullying.

Complaints of this nature are worrying, stressful and have serious implications for your organisation. In addition to the risk of costly financial penalties, they negatively affect productivity, management resources, staff morale and public image. Navigating such issues is always tricky. We can assist with providing advice to guide your business through this complex and sensitive legal area.

Disciplinaries and termination of employment

Handling the investigation and discipline of staff can be daunting, as can the steps to be taken to terminate the employment of any member of staff, let alone a senior member of an organisation can be a highly sensitive matter. Should your business ever find itself in this position, we will advise you how to balance the needs of the business against the rights of the individual to deal with the situation in a fair manner, consistent manner, whilst also protecting your business interests and avoiding any potential negative fallout. We help you to achieve these goals.

Personnel records and employee data privacy

In this age of enhanced privacy rights we advise you in relation to the personal data you can retain about your workers. The extent of the monitoring that can take place of employees using the organisation’s electronic equipment. We advise you on your business rights and obligations in the management of personal employee information. In addition to these external challenges companies face from regulatory authorities to keep employee and third parties data secure.

We will guide you through the laws and regulations your business needs to adhere to this which includes: dealing with subject access requests, advising on best practice, and the use of employee and company owned computer equipment such as laptops and smart phone devices.

Promotion and recruitment

We advise you on the content of your job adverts, application forms and promotion of employment opportunities to ensure that they are in keeping with the expectations of the law.

With the increasing need to account for the pay structures and the harmonisation of gender equality pay we advise you on your obligations to your employees and the standards of reporting and clarity required of your business.

Redundancy

If you are going through a difficult trading period, you may need to reduce your workforce to ensure the financial viability of your business, we can asset you with ensuring the correct and fair and legal process is followed to see you through this difficult period.

Our Fees

The above is just a sample of the work we carry. If you would like any further information or need advice on employment law, please contact us our rates range from £190.00 to £220.00 per hour depending in the complexity of the matter.

Employees

We will support and advise you in relation to any difficulties you are experiencing with your employer.

You may never have attended a grievance meeting, disciplinary hearing or indeed an employment tribunal before, so it’s only natural seek advice to relieve any anxieties you may have. Having expert lawyers on your side means you can be well prepared and confident that your voice will be heard.

Employment tribunal litigation and appeals

Not all cases necessarily proceed to an employment tribunal. We can often advise you on the most cost effective, non-contentious resolution to any difficulties you may be having with your employer.

Should it be necessary for a case to be taken to tribunal our experienced employment department will support you in bringing tribunal proceedings.

We will carefully explain to you what is involved and will ensure that you are given the best advice and support from your initial contact with us to a successful conclusion.

Should your case need to proceed to an employment tribunal, we have significant expertise in protecting the interests of employees as over the years we have acted for employees in many cases.

Restrictive Covenants and breach of contract disputes

If you have worked for an employer and decide that your future lies elsewhere you may find that your current contact of employment contains restrictions which prohibit you from working for a new employer. We can advise you on the enforceability of your contractual provisions which may not be enforceable as your employer suggests leaving you free work where you chose.

Discrimination, victimisation and harassment

If you are having difficulty with your employer and feel that you have been treated unfairly, or that you are being discriminated against, then please do not hesitate to contact us as we have extensive knowledge and experience of dealing with a wide range of discrimination claims.

We provide answers to all your questions, ranging from what is a protected characteristic, the effects of this on your daily interaction at work and how the law offer workers the strongest protection against discrimination specific to your cultural sensitivities. Should you suffer from an act of victimisation and harassment we can advise you how to assert your rights.

We provide a standard of dedicated service that leaves you in no doubt that we care about you and whether your rights have been breached.

Parental and family-friendly rights

We offer a wide range of advice stemming from a right to request to work flexibly to enforcing your rights during maternity leave and after your family has been born.

Redundancy and Unfair dismissal

There are limited reasons that an employer can use to bring the employment relationship to an end after an employee has worked in excess of two years. If you are a protected employee your employer must have a fair reason and follow a fair process in order to bring your employment to an end. If you feel that you have suffered from unfair treatment we can explore with you your rights and whether you are correct in your assumptions and whether the matter is actionable.

Settlement negotiations

Drawing on extensive experience and in-depth knowledge, we can help you to avoid the risk of litigation, financial exposure and reputational damage. We advise you on out of court settlement agreements to give you the best advice on your position should the worst happen and your employment relationship with your current employer be brought to an end. We help you to secure the best possible outcome.

Our Fees

The above is just a sample of the work we carry. If you would like any further information or need advice on employment law, please contact us, our rate range from £180.00 to £220.00 per hour depending in the complexity of the matter.

____________ is experienced in advising in all areas of Family Law. _______ can assist couples who are going through a separation or if assistance is required in relation to a dispute relating to children arrangements. ______ can also help obtain necessary Court Orders to assist victims of domestic violence.

Please see our related services below;

- Fixed Fee First Meetings

- Divorce

- Financial Provision

- Children Arrangements

- Cohabiting Couples

- Domestic Violence

Fixed Fee First Meetings

We offer an initial face to face appointment to ensure that we fully understand your situation. During this appointment, we will not only take your full instructions, we will provide you with the in depth advice that you require and we will outline all of your options and the likely costs involved.

Our Fees

This appointment is charged at a fixed fee of £150.00 plus VAT.

Divorce

It can be quite a stressful experience when going through a separation. There are a range of issues which need to be considered and we will do our best to ensure that the process is completed as smoothly as possible.

We will ensure that the process is completed as quickly as possible and it is our aim to ensure that all matters are dealt with in a friendly and non-confrontational manner.

Our Fees

We offer a divorce under a fixed fee of £500.00 plus VAT.

This provides you with the assurance that your legal costs will not increase during the case, if further steps need to be taken.

Other Expenses

There is an initial Court fee of £550.00 for filing your divorce petition with the Court and there may be further Court fees applicable, if your case requires further action to be taken.

Financial Provision

During a divorce there will almost always be financial matters which need to be considered. This may involve a property, pensions, debt or other issues which you will require assistance with. ______ will ensure that these matters are addressed from the outset, with the aim of reaching a suitable settlement.

It may not be possible to reach an agreement during negotiations and if so, _____ will take the necessary steps to progress your matter to a successful conclusion. If this requires an application to the Court, _______ will take the necessary steps to ensure that you obtain a favourable overall financial settlement.

Our Fees

Work is charged at an hourly rate of £175 + VAT – estimate of costs will be provided after initial discussions as work involved can vary from matter to matter.

Children Arrangements

Reaching an agreement with your ex-partner in relation to the arrangements for your children can often be difficult. At Bates Wells and Braithwaite we take a non-confrontational approach, with the aim of assisting you in reaching an agreement which is in your children’s best interests and is sustainable as a long term routine.

If an agreement cannot be reached, ________ will take the appropriate steps to ensure that you have an arrangement in place which will rectify the previous difficulties you were experiencing.

This may involve proceeding with an application to the Court and if so, _________ will obtain an Order which will provide you with a suitable routine for your children and establish a long term arrangement for the children to settle into.

Our Fees

Work is charged at an hourly rate of £175 + VAT – estimate of costs will be provided after initial discussions as work involved can vary from matter to matter.

Cohabiting Couples

The law in relation to cohabitation is often misunderstood. It is our aim to ensure that you fully know what your legal position is in respect of any assets you own with your ex-partner.

It is quite common for unmarried couples to own a property together and upon separation the issue arises as to what happens to this property. We will ensure that you obtain the correct advice in relation to your options and this will enable you to make the appropriate choice in regard to the next steps you wish to take.

Our Fees

Work is charged at an hourly rate of £175 + VAT – estimate of costs will be provided after initial discussions as work involved can vary from matter to matter.

Domestic Violence

As a victim of domestic violence it is imperative that you receive the appropriate support and assistance available to you. It is important to be aware that the definition of domestic violence is not limited to physical violence and there are different types of abusive behaviour that you are able to obtain assistance for. _________ will ensure that the appropriate steps are taken immediately, which may involve applying to the Court for emergency Orders, if your situation requires such steps to be taken.

Our Fees

Work is charged at an hourly rate of £175 + VAT – estimate of costs will be provided after initial discussions as work involved can vary from matter to matter.

Other Expenses

Various expenses such as court fees may apply but you would be advised of them in advance of any such fee being required.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged.

Please see our related services below;

Road Traffic Accidents

Medical Negligence

Criminal Injuries

Slip Trip or Fall

Injury at Work

Lorraine Moser and Matthew Stamp are experienced in advising on the buying and selling of freehold and leasehold residential property, remortgages, Deeds of Gift, Declaration of Trusts and Transfers of Equity. They are assisted by Trainee Conveyancer Emily Turner. They offer a personal service assisted by dedicated secretarial support recognising the importance of prompt and regular communication throughout a transaction.

Please see our related services below;

Conveyancing

One of the most common reasons for using a solicitor will be for buying or selling property. Unfortunately the whole process has a reputation of taking too long and being enormously stressful. It should be an exciting time and for most people will be the most significant financial transaction they undertake in their lifetime. Regrettably too many law firms employ large teams of inexperienced and unqualified staff and work in a “call centre” environment.

We pride ourselves on the personal service that our lawyers provide, Matthew and Lorraine have a combined service with Bates Wells & Braithwaite in excess of 50 years and are recommended by local agents and other professionals.

Many of our client return to us time and time again and recommend us to family and friends.

The Conveyancing Team gained Conveyancing Quality Scheme Accreditation in 2011, a scheme introduced by the Law Society to provide a recognised quality standard for residential conveyancing practises.

Sales of Residential Property

The Process

The work that is generally undertaken in respect of a sale transaction includes the following:

- Taking initial instructions.

- Checking the title and preparing Contract documents.

- Dealing with enquiries raised by the buyer’s conveyancer.

- Agreeing exchange and completion dates and subsequently dealing with the exchange and completion.

- Receiving funds from buyer’s solicitor paying off any mortgage that you have secured on the property.

- Accounting to you for net sale proceeds.

How long will this take?

A number of factors need to be taken into account when looking at the length of time a transaction will take. Typically the process takes between 8 and 12 weeks.

The length of time will vary depending on the number of parties in the chain, whether parties require mortgage financing, whether surveys are being undertaken or whether a property is freehold or leasehold.

Our Charges

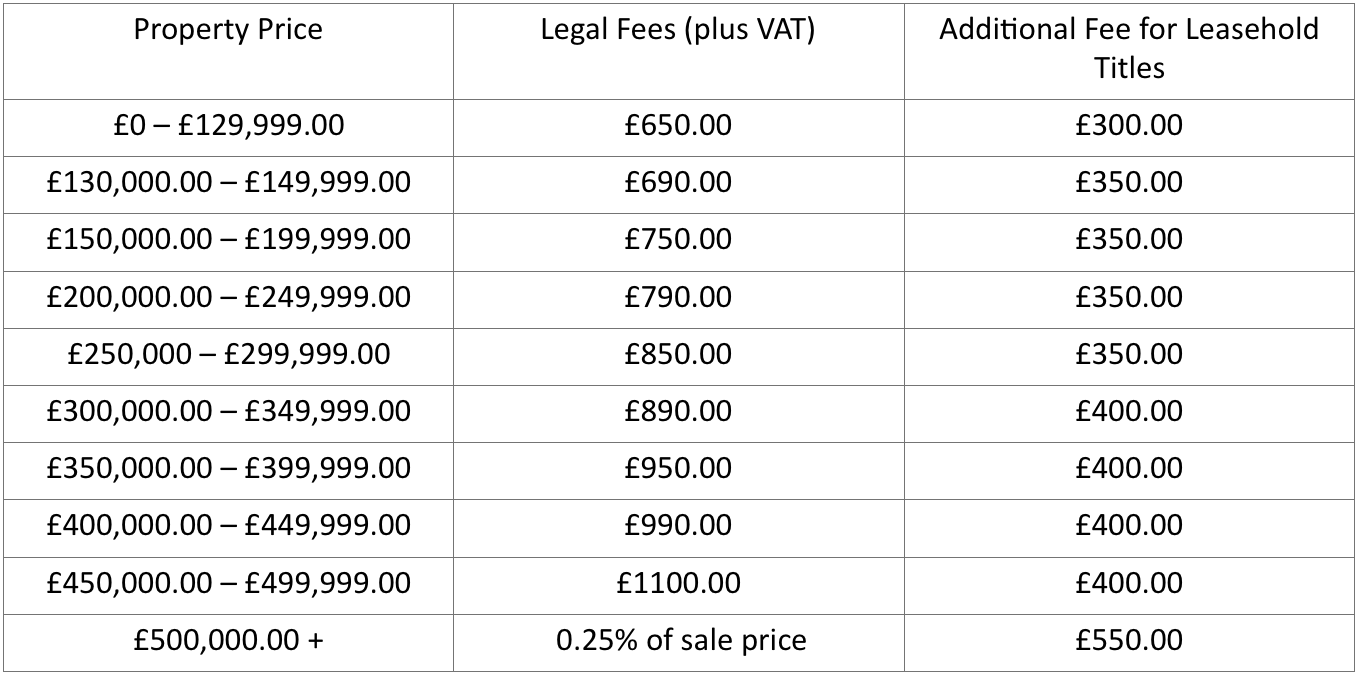

Our fees will vary depending on the value of the property that you are selling but are broadly based on the scale below. Our fees are subject to VAT at 20%. In addition to our legal fees in relation to the sale of a property you should also expect to pay for up to date copies of title registers approximately £10 and for the administration charges and bank fees for the electronic transfer of funds currently totally £25 plus VAT. With the sale of a leasehold property there will also be charges payable in relation to management company information and those third party fees will not generally be known to us at the outset of the transaction but will be ascertained by us as early as possible and you will be advised as soon as that information in available.

In the event that your transaction becomes abortive our fees will be charged on the basis of the time spent at an hourly rate of £175 per hour plus VAT

Purchase of Residential Property

The Process

- Taking initial instructions.

- Obtaining Contract documentation from the seller’s solicitors and reviewing that documentation./li>

- Implementing search applications and raising any enquiries as a result of title investigation and reviewing search results.

- Reviewing any mortgage offer and advising you with regard to the conditions.

- Reporting to you on Contract documentation.

- Agreeing exchange and completion dates and then undertaking the exchange and completion.

- Arranging for the transfer of funds to the seller’s solicitors.

- Attending to payment of Stamp Duty Land Tax and making the Land Registry application and attending to any requisitions raised by them.

- Reporting to you and any mortgagee following registration.

How long will this take?

A number of factors need to be taken into account when looking at the length of time a transaction will take. Typically the process takes between 8 and 12 weeks.

The length of time will vary depending on the number of parties in the chain, whether parties require mortgage financing, whether surveys are being undertaken or whether a property is freehold or leasehold.

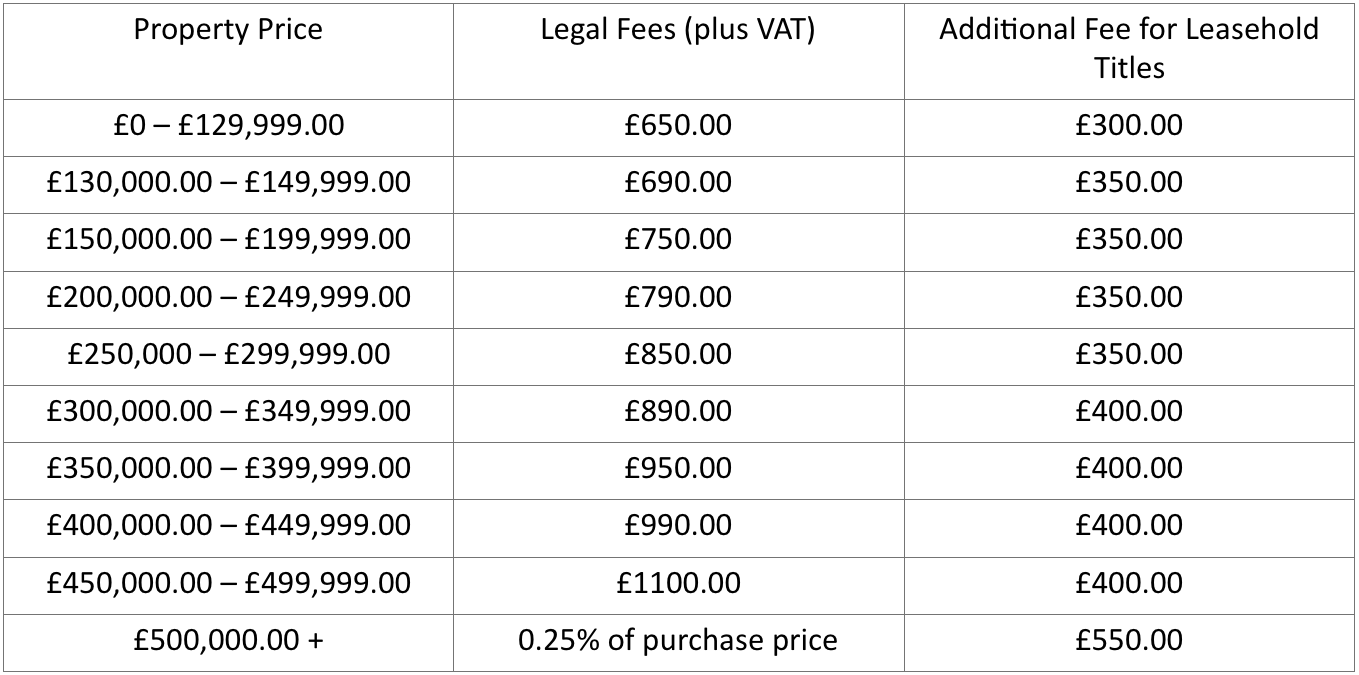

Our Charges

Our fees will vary depending on the value of the property that you are buying but are broadly based on the scale below. Our fees are subject to VAT at 20%. In additional to our legal fees in relation to the purchase of a property you should also expect to pay for searches is approximately £350 and for the administration charges and bank fees for the electronic transfer of funds currently totally £25 plus VAT. With the purchase of a leasehold property there will also be charges payable to the management company and/or landlord and those third party fees will not generally be known to us at the outset of the transaction but will be ascertained by us as early as possible and you will be advised as soon as that information in available.

You will also be required to pay Stamp Duty Land Tax and Land Registry fees both of which are calculated on the property value. We can let you know what those fees are when we provide a formal estimate of charges.

In the event that your transaction becomes abortive our fees will be charged on the basis of the time spent at an hourly rate of £175 per hour plus VAT.

Remortgages

The Process

The work that is generally undertaken in respect of a remortgage transaction includes the following:-

- Acting for both you and your lender.

- Taking you initial instructions.

- Reviewing mortgage offer and reporting to you on the conditions of it.

- Reporting to the lender and arranging for release of funds.

- Dealing with the repayment of any prior mortgage.

- Making application to the Land Registry for registration of the new mortgage.

- Accounting to you for any net mortgage advance.

Our Charges

Our fees for acting for you and a lender on a remortgage will be £450 plus VAT.

Our fee is likely to be higher than that quoted above if:-

- Title to your property is unregistered;

- Your new mortgage lender is not a main stream lender

- Title to your property is leasehold.

In addition to legal fees there will be additional costs which are likely to be as follows:-

- Administration costs and bank fees for the electronic transfer of funds £25 plus VAT for each transfer made.

- Search fees payable to third parties approximately £350.

- Land Registry fees which vary dependent upon the amount of the new mortgage advance and whether the property is already registered at the Land Registry or whether the mortgage necessitates an application for compulsory first registration.

How long will it take?

The length of time that a remortgage will take depends heavily on the lender concerned and the time that local authorities are taking to process searches. A typical transaction would take approximately 4 weeks.

Equity Releases

Deed of Gift

Declaration of Trust

Glenn Blair and Catherine Palmer are experienced in advising on and preparing documents for Wills, Lasting Powers of Attorney and Trusts. They can also help in obtaining a Grant of Probate and conducting Estate Administration and in making applications to the Court of Protection.

Please see our related services below;

Court of Protection

It is a commonly-held belief that it is not necessary to complete a Lasting Power of Attorney (LPA) until it is needed – i.e. until someone loses the ability to deal with their own affairs. However, by that stage it is too late, as the individual will also have lost the ability (the necessary mental capacity) to sign an LPA.

If you have a relative who has lost mental capacity and you need to help them with their affairs, you will need to apply to the Court of Protection to be appointed as their Deputy. At Bates Wells & Braithwaite, we can assist you with making your application to the Court, issuing the necessary Notices to specified individuals and obtaining a Deputy’s Bond, so that you can assume your role.

What will happen?

We will meet with you to discuss the process and the cost of applying for a Court of Protection Deputyship Order, explain to you the information which will be required, and complete the final forms for signature by you. We will also submit the request for a mental capacity assessment to your loved-one’s medical practitioner. We will then send all completed documents to the Court, together with your fee, and deal with any queries which the Court may have.

Once your application has been issued (initially accepted). we will also issue Notices on your behalf informing relevant people of your application.

Finally, once the Order is made, we will assist you in obtaining your Deputy’s Bond.

Fees

We charge an hourly fee of £195 plus VAT for this work. The Court automatically allows for a charge of £850 plus VAT, provided there is no extra or unusual work involved. If there is extra or unusual work involved the Court usually gives permission for higher fees to be charged and agreed by the Deputy.

Various expenses may also be required such as (but not limited to) the following:

- GP/Medical Professional Fee – can vary

- Court Application Fee – £385

- Other court fees (if required) – can vary (usually nothing extra is required)

- Bond Fee (type of insurance that can be requested by the Court) – can vary

Powers of Attorney

As people live longer, the chances of an individual reaching a point where they are unable to handle their own affairs increase. It is therefore important that you sign and register a Lasting Power of Attorney (LPA), giving another person or persons power to deal with your finances in the event that you become physically or mentally unable to do so. You can also make a Lasting Power of Attorney appointing someone to make decisions regarding your health and welfare. Both of these documents need to be completed whilst you (the Donor) still have the mental capacity to do so.

At Bates Wells & Braithwaite, we can explain exactly how to make, register and use Lasting Powers of Attorney. We can also advise on the appointment of suitable Attorneys and (usually) act as your Certificate Provider for the document – that is, sign to confirm that, in our opinion, you have the necessary capacity.

What will happen?

We will meet with you to discuss Lasting Powers of Attorney in general and help you decide which document(s) you require. We will also explain the duties and responsibilities of an Attorney, to help you ensure that you are appointing suitable people.

When you sign the document, we will witness your signature and then send the LPA to your Attorneys for them to sign.

We will then arrange for the LPA to be registered by the Office of the Public Guardian and, when this has been done, provide you with the necessary certified copies for your use.

Additional Services

We will store your original Lasting Power of Attorney in our strong room free of charge and provide further certified copies if required in the future (there may be a small charge for additional certified copies).

The Directors of Bates Wells & Braithwaite are prepared to be appointed as your Attorney, if there is no-one else whom you feel is appropriate. In these circumstances, we are precluded from acting as your Certificate Provider and someone else will need to be named in that role.

We can also deal with the registration of Enduring Powers of Attorney

Fees

Single LPA document – £420

Double LPA documents – £600

2 x double LPA documents – £950

Prices of other combinations and registration of Enduring Powers of Attorney available on request.

Wills

Wills are an important document and necessary to ensure that your estate, after your death, is dealt with in the way you would have wanted. Producing a Will is a service many organisations offer. However, by providing proper advice about the content and implications of dealing with things in a certain way professional regulated bodies such as Bates Wells & Braithwaite Solicitors can ensure that your aims are achieved.

Making a Will at any age can be seen as a daunting process, but Glenn and Catherine will do their best to make the process as simple and worry free as possible.

If you already have a Will and wish to discuss updates or amendments this may be possible via the use of a Codicil rather than a full new Will, this is something that Bates Wells & Braithwaite can advise on and prepare for you if needed.

What will happen?

We will meet with you face to face to discuss your circumstances and wishes, provide you with advice to suit your needs, including advice on Inheritance Tax if required.

A draft document is then prepared and sent to you for approval along with a detailed letter explaining the clauses used (in plain English).

We will then oversee the signing and witnessing of the final document

Additional Services

We can meet with you at our offices or at your home*

We can arrange for the safe storage of your documents , free of charge

After your death we offer to meet with your executors to ensure they know what is required of them, this is a no obligation meeting and is usually free of charge.

Fees

For simple Wills this firm operates a fixed cost approach as follows:

Single Will – £180 + VAT

Mirror Will – £250 + VAT (a pair of wills that is broadly on the same terms as each other)

For more complicated Wills or advice, the fee will be discussed with you before work is conducted and will either be charged at a higher fixed fee or based on an hourly rate of £195 + VAT per hour.

Codicils start at £120 + VAT, but final price is confirmed after the initial meeting and depends on the amount of advice given and the number and nature of the changes being made from your original Will.

If you are making Wills at the same time as Lasting Powers of Attorney a reduced “package” fee might be offered.

*home visits need to be pre-arranged and additional fees may apply

Trusts

Whilst Trusts in a general sense are not as useful as they may have once been, they can still have uses and depending on circumstances be the best way to achieve your aim.

We can advise on and assist with the setting up of various different trusts including but not limited to trusts created by a Will, Trusts for Disabled Beneficiaries, and Trusts for Bereaved Minors.

We can discuss with you the tax implications of various trusts including Inheritance Tax consequences to your own estate for paying money into a trust as well as any on-going Inheritance tax liabilities of the trust itself, Capital Gains Tax and Income Tax*

We can also discuss the wider issues with regards setting up trusts such as Deliberate Deprivation of Capital or the consequences of giving assets away.

* Whilst we can advise on what taxes may apply and when, we may not be able to provide you with exact calculations and complete tax returns for you and may recommend you speak to an independent accountant for these aspects.

Fees

We charge an hourly rate of £195 + VAT for all work involved. If the matter is complicated or under time restraints we may charge £215 per hour + VAT.

Probate

Certain things in life are inevitable and unfortunately one of those things is death. Dealing with the loss of a loved one can be hard enough anyway but it is at this time that we are often forced into learning a whole new system of dealing with deceased’s assets and liabilities which often includes applying for a Grant of Probate (or Letter of Administration if there is no Will).

Glenn Blair and Catherine Palmer are on hand to offer advice and assistance to suit your needs which can be in simply explaining the process, completing the forms to obtain probate or in doing all the work in administering an estate.

Guidance

Following a death we can hold a meeting with you to discuss various options and ways forward. Our aim is for you to understand the process and work involved so you can make an informed decision about how you would like to proceed.

We can also help you plan for what work is essential and what is not so you can focus on those matters that really concern you in the early days following a death such as the funeral.

If the deceased held a Will with this firm, or following the meeting we receive instructions for further work then this meeting is usually free of charge although if it is not you will be advised before the meeting and costs will be capped at £195 + VAT.

Grant of Probate

We can help you in obtaining a Grant of Probate. This work is usually done as a fixed fee for “simple” cases – smaller estates where an IHT205 needs to be completed we charge £500 + VAT for larger estates where an IHT400 is required (which is in all cases where Inheritance Tax might be due) we charge £1000 + VAT.)

We would advise you of any increased costs as soon as it became clear that any additional unusual work was required.

Please note that these fees are on the assumption that all figures and information required are provided to this firm without additional correspondence from the firm required.

Administration of Estate

We can complete all the work in the estate on your behalf including:

- Liaising with third parties to close accounts and obtain all information required for Probate

- Obtaining Probate

- Closing Accounts/Selling Assets

- Paying debts/liabilities

- Distributing estate according to the Will

Estate administration work is conducted at an hourly rate of £195 + VAT for simple matters or £215 + VAT for complicated matters.

As an example a medium sized estate (assets below Inheritance Tax thresholds, including a property and a number of bank accounts and investments) usually costs between £2,000 and £4,000.

Please note that the value of the estate is not necessarily an indicator of the work involved and small estates can sometimes cost more to administer than large and vice versa depending on a number of factors including type of assets involved, where they might be held and number of beneficiaries.

An official estimate of costs is provided once an overview of the work involved can be ascertained.